Bitcoin is holding on for dear life after quite a bumpy rollercoaster ride this past year, or is it?

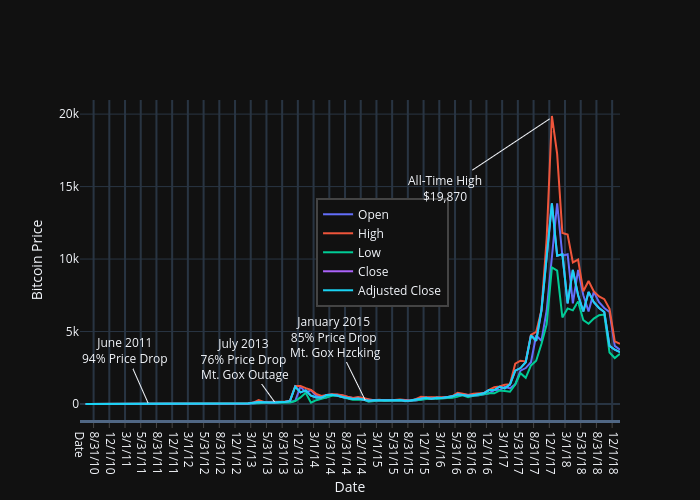

At the end of 2017 and the beginning of 2018, the cryptocurrency was soaring at an all-time high of $20,000 on the CoinDesk Price Index. People were dumping money into the exchanges which ended up skyrocketing the value price. Since the strong insurgence Bitcoin has plummeted all the way back below $4000.

In November of 2017, the price per Bitcoin hovered at about $4000. With the price jump to $20,000 in the short amount of time, it was inevitable that the Bitcoin market would be due for a correction. It’s rare that a rise so strong wouldn’t trigger a correction. Corrections happen all the time in the stock market. Generally, corrections in the stock market are only about 10%. In Bitcoin’s instance, the digital currency dropped about 80%.

This doesn’t mean Bitcoin has met its end. Bitcoin has been through major price drops in the past, so this is nothing new to the seasoned crypto investor. The first major Bitcoin drop happened in June of 2011 when the currency dropped from $32 to a measly $2, a 94% drop. During a 3-month span in 2013 from April to July, Bitcoin’s price dropped from $266 to $63, a mighty 76%. Media coverage helped the rise of the price and before an outage of the Mt. Gox exchange contributed to the decline in price. Mt. Gox was the biggest exchange to buy Bitcoin on in 2013 as it handled 80% of all Bitcoin transactions in the world.

The longest lasting correction of Bitcoin started in November 2013 and ended in January 2015. Over the span of 410 days Bitcoin’s price dropped from $1166 to $170, a whopping 85%. During this time period in 2014, Mt. Gox was hacked and 850,000 Bitcoin were stolen. This opened many securities concerns regarding the currency. It also led to the bankruptcy of Mt Gox. Currently Mt. Gox is still going through bankruptcy proceedings as of 2018.

In 2017 Bitcoin had its fair share of price drops until smashing the all-time high at the end of the year. Three price corrections occurred in 2017, in March, June to July and in September. All those drops were around 25% to 40%. Most of the decline is attributed to China’s crackdown on Initial Coin Offerings, laws on crypto mining, and rumors of trade banning.

Yes, there have been quite a few steep corrections in Bitcoin’s history, but the evidence shows the resilient digital currency has made it out every time. Most of the time the cryptocurrency resurges by beating previous all-time highs. If Bitcoin’s past is the pathway to its future, there’s no way to go but up, especially for people who believe in Bitcoin for the long term.

There is no concrete evidence that Bitcoin is destined to fail. If Bitcoin were to fail, there are many other technologies that were associated with the currency that can be used. Specifically, blockchain has many uses and is being explored by many companies around the world. According to Forbes American Express, IBM, Oracle, JPMorgan Chase, Toyota, Samsung, and Apple.

One personwho has invested in Bitcoin isn’t worried. “At $20,000 I said if Bitcoin ever hit below $5000, I would buy it, it has now and I may just have to buy, said Al Romero. Al’s statement matches some others, especially those who knew about Bitcoin when it was around $20. Al was also one of those people. “During the time of Silk Road, I was interested in Bitcoin but was skeptical, and I missed out”, Al stated.

Not all people feel the same way though. Coinbase user and small personal Investor Dustin Hildebrand said, “The price drop has made me nervous.” Though nervous, Dustin said, “I have not sold my holdings, but I have not invested more either.”

The volatile market isn’t the only driving factor behind Bitcoin’s price. According to a report from the St. Louis Federal Reserve, Altcoins will put downward pressure on the buying power of the coin and possibly devalue Bitcoin.

Even with Altcoins flooding the market, the St. Louis Federal Reserve believes the price will not reach zero. The report is confident that the price will hover somewhere between what the bears and bulls want to happen, and that Bitcoin has a necessary value with its decentralized systems.

Bitcoin’s heart lies in the SHA-256 algorithm. The SHA-256 algorithm is one of the most used algorithms in the world. Owner and lead software engineer at Kryptronic, Nick Hendler said, “The SHA-256 was right algorithm chosen by Satoshi for security purposes”. He also stated, “Most websites today use SHA-256 encryption to keep consumer data safe”. Satoshi Nakamoto built Bitcoin with computer coding and programming. Computer programming and coding can all be improved and that is all Bitcoin is. Improvements are inevitable, especially as more companies pour money into researching it.

Bitcoin’s price does seem to be on a roller coaster track with its price due its volatility. This could mean bad news for the currency this time. People are becoming concerned. “I had some stake in a small company, made profit and got out,’ says Justin Skaggs. “The pace Bitcoin’s price jumps up and crashes down is alarming,” he added.

The constant moving price of the market its driven by a few items, the trading volume and the mining volume. According to JP Morgan, cryptocurrency miners are beginning to exit the market due the cost of mining outweighing the reward of mining a single Bitcoin.

Also, cryptocurrency mining is quickly becoming not profitable. If a person in Pennsylvania spent one full 24-hour day mining Bitcoin with the Bitmain Antminer S9 with 14 TH/s of hashing power consuming 1600W an hour at the current price of $3528.70, $2.82 would be lost on that day alone. That means if the person mined over a year’s time it would cost $1009.40 plus the initial cost of the Bitcoin miner. If the market price of Bitcoin keeps dropping there will be no incentive for miners. An event like that could be the driving factor to end the currency. The profit was calculated using this online crypto calculator.

Something else to watch out for is the trading volume. Over the past couple of days, the volume of Bitcoin trading has dropped about 2 billion.

The currency could be doomed even though there is still plenty of room for the Bitcoin to grow. With on the growing worldwide acceptance, the stock exchanges with Bitcoin futures, and the ongoing government regulation, Bitcoin and cryptocurrencies could very well be here to stay. Also, with crypto mining being popular, it would be hard to get rid of something completely with support Bitcoin has. The interest is here and continues to grow.

“It’s still a misunderstood technology,” said Daniel Keller, CIO of Windfall Mining, about Bitcoin and Bitcoin mining. According to some inventors, Bitcoin could potentially be this generation’s technological revolution. Time will tell. Taking the time to learn could be beneficial. Taking the time to learn about Bitcoin could prepare those for the future of finance.

For now, Bitcoin may not be dead. Bitcoin may have survived this major drop to still live another day. Will it survive the next drop? The future holds what is in store for the currency.

To learn more about Bitcoin go here. For more cryptocurrency and Bitcoin related content follow @LateNightBTC on Twitter and head on over to Facebook and Like the Late Night Bitcoin Facebook page.

A Twitter List by LateNightBTC https://platform.twitter.com/widgets.js

Leave a comment